Strategic Overview

In rapidly advancing digital finance environments, mission-critical decision-making is essential. Today’s discussion dives into how robust data strategies—with a focus on KPIs, automated alerts, and form input augmentation enhances decision transparency and operational efficiency—can empower teams to overcome evolving challenges. Leading institutions such as JPMorgan Chase and Goldman Sachs have embraced these innovations, while thought leaders, including insights from Forbes and trends noted at Dartmouth Tuck School, underscore the transformative power of traceable data and AI-driven tools like Microsoft Copilot.

Building a Robust Data Foundation

A traceable, real-time data infrastructure is the backbone of modern financial decision-making. Emphasizing automated experiment tracking and verifiable logic pathways ensures that every data point contributes to a reliable system. Reengineering reporting templates and connecting raw input data with live KPIs offer a visual workflow that maps data feeds directly to key business indicators.

Advanced Utilization Techniques and Expert Perspectives

AI-driven co-pilot techniques have redefined decision-making for many high-performing fintech teams. Case studies reveal that refined risk management protocols and transparent processes lead to increased operational success. Implementations of advanced tracking and alert systems have recalibrated financial offerings and significantly boosted win rates. Detailed, real-world scenarios, such as those from fraud detection sequences inspired by Revolut's methodology, show the effectiveness of these approaches.

- Real-Time Risk Scoring

- A method that continuously evaluates risk by processing live data streams and flagging anomalies instantly.

- Embedded Analytics

- This involves integrating analytic tools directly within business platforms, enabling immediate access to actionable insights.

Implementing Data-Driven Tactics

Transitioning from traditional practices to data-augmented processes calls for a methodical approach. Consider the following step-by-step tactics designed to seamlessly integrate advanced tools into everyday operations:

| Data Signal | Tool Used | Decision Impact |

|---|---|---|

| Audit of Reporting Templates | Automated Audit Trails | Identifies data gaps quickly |

| Data Collection Mapping | Microsoft Copilot | Ensures seamless KPI tracking |

| Experiment Tracking | Automated Analytics | Monitors test phase performance |

| Cross-Functional Review Meetings | Agile Feedback Loops | Facilitates iterative improvements |

| Note: Integrating these steps can enhance decision accuracy and support continuous refinements. Keywords: automated KPI alerts, experiment tracking, real-time data. | ||

These tactics ensure that every update is aligned with a clear strategy, reducing the margin of error and positioning teams to quickly identify and respond to data discrepancies.

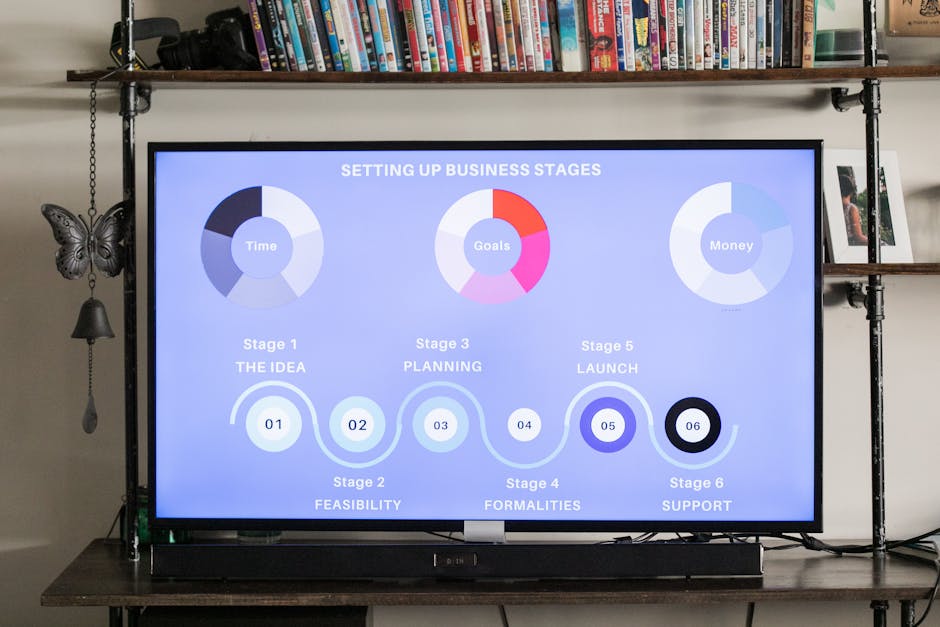

Visualizing Impact and Driving Future Strategy

Engaging visuals are crucial to demystify complex data relationships. Detailed charts, diagrams, and models illustrate how integrated data systems influence monetization strategies and risk control. Reflecting on historical transformations, organizations have strategically pivoted following AI rollout phases, optimizing their processes for immediate application.

Additional Insights and Techniques

Delving deeper into effective practices, consider a brief case study:

A leading fintech team iteratively refined their reporting templates by incorporating automated KPI alerts and audit trails. They adopted anomaly detection algorithms to monitor data flow discrepancies, aligning with critical compliance requirements. By integrating APIs from reputable data providers, they not only boosted reporting accuracy but also maintained a resilient decision-making process.

Click here for deeper technical insights

The team employed agile feedback loops during cross-functional review meetings, allowing them to adjust real-time risk scoring models and embedded analytics systems dynamically. This adaptive approach, supported by continuous experiment tracking, enabled them to quickly pivot strategies, ensuring that every insight was not only actionable but also traced back to reliable data sources.